My life in #10yearchallenge memes

Unless you live in a cave or are on some sort of social media detox (#2019Resolutions), I’m guessing you’re up-to-date with the 10-year challenge rant.

At first I wanted to take part of it and post a before-and-after picture of myself (because why not), but then I realized I didn’t come this far in life to voluntarily post pictures of me in 2009.

Instead, I have gathered a few of my favorite 10-year challenge memes (and drawings) for you to enjoy.

A lot of things happened this past decade.

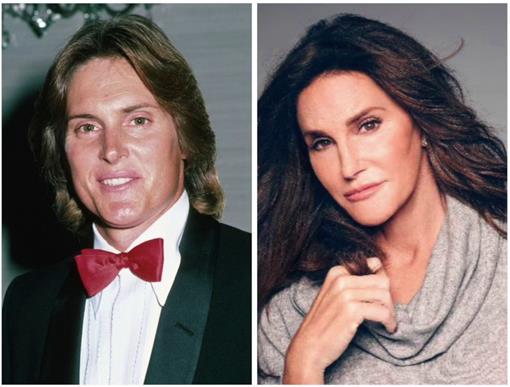

1- Some people changed

2- Some people stayed the same

3- Some people stayed the same but changed their eyebrows

(Because trends and all…)

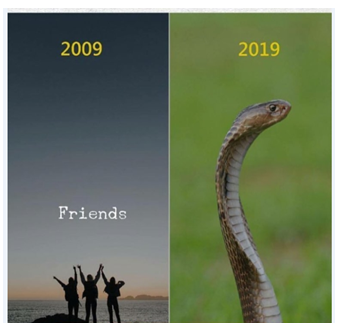

4- And some of them showed their true colors

(This one took less than 10 years though)

And then there are the things that stayed the same.

5- Like my relationship status

5 bis- More of my relationship status…

6- And my financial status

7- And my anxiety

8- I started seeing things differently

(They did warn me this might happen when I start growing up)

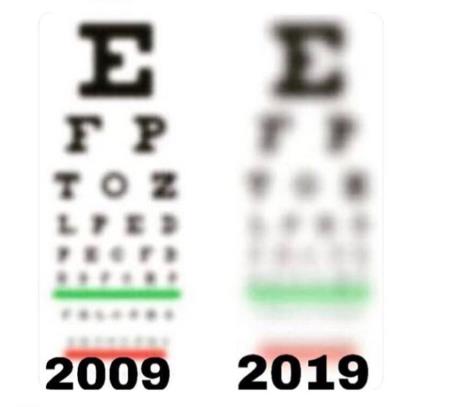

9- Even if life got blurry sometimes…

(Well…blurrier**)

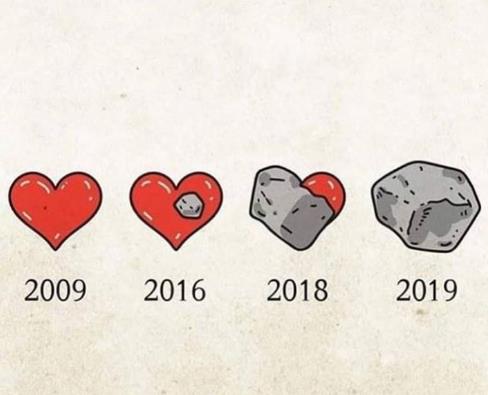

10- My heart turned to stone

10 bis- This one happened progressively though…

(I learned how to get over it with a smile)

11- It was a bit exhausting to be honest

(But I did learn a lot)

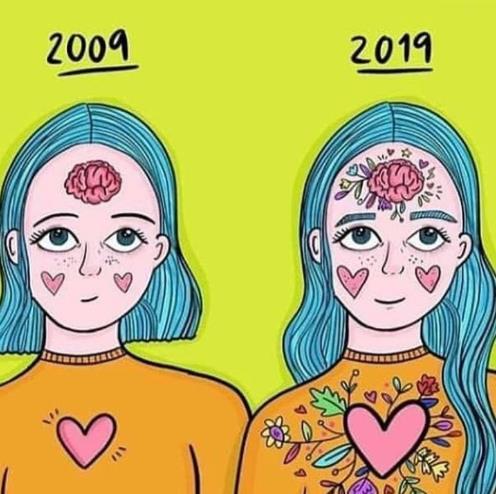

12- Most importantly, I experienced growth

And for that, I am truly deeply grateful!

All in all, it was fun while it lasted!

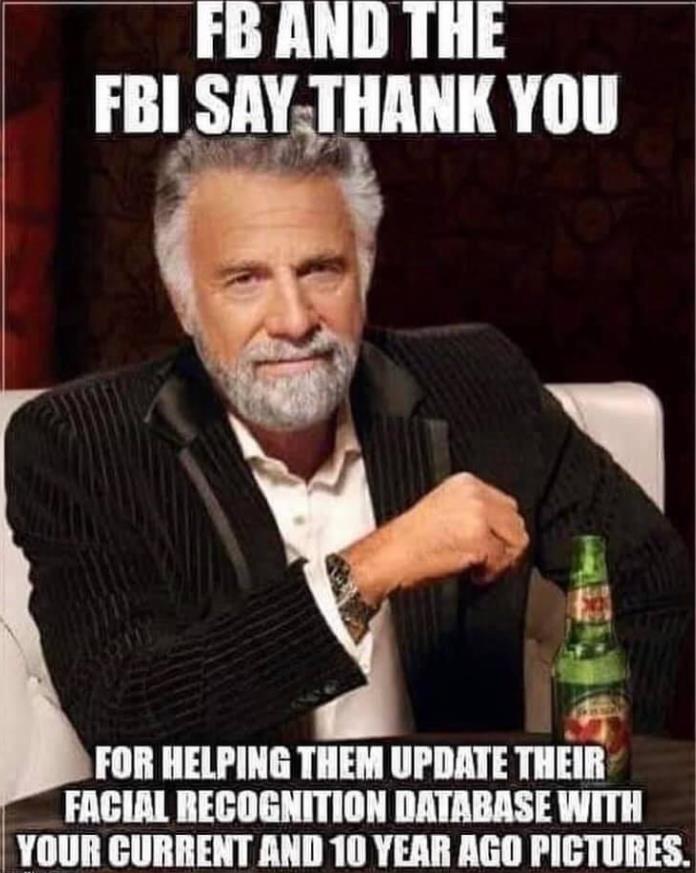

On another note (jokes and memes aside), here’s a message from Facebook and the FBI: